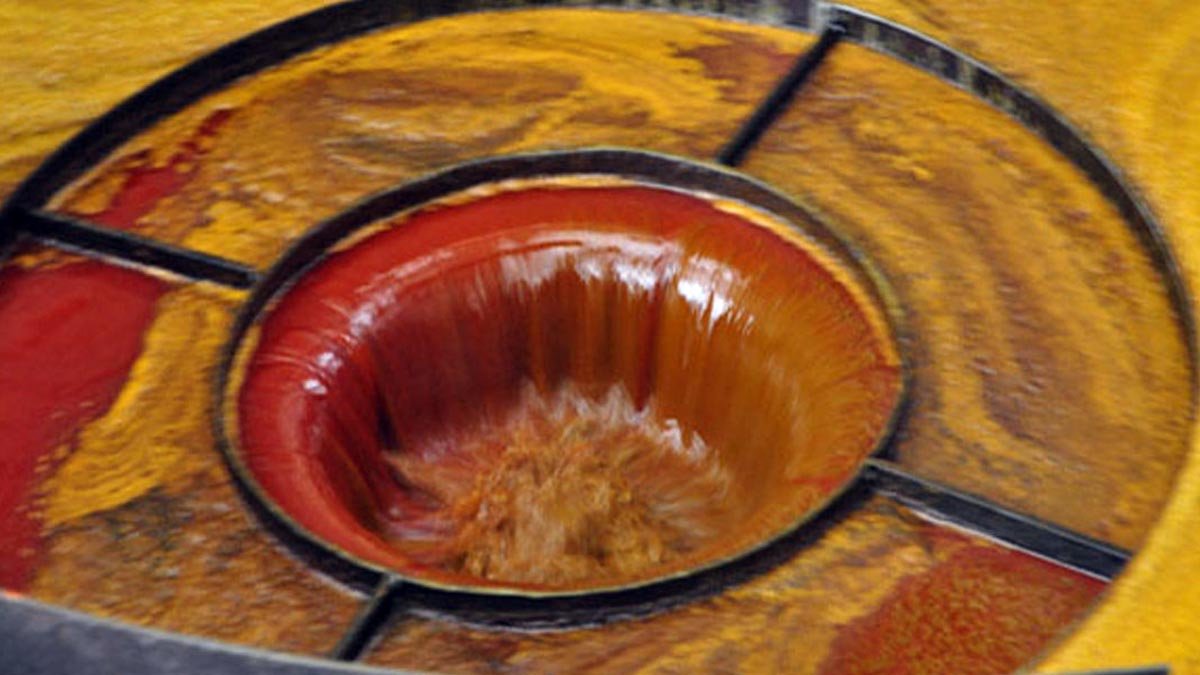

PALMOILMAGAZINE, JAKARTA — Crude palm oil (CPO) prices at PT Kharisma Pemasaran Bersama Nusantara (KPBN) were withdrawn on Friday (Nov 7, 2025), as the highest bid reached only IDR13,615 per kilogram. The figure marks a decline of IDR213/kg or 1.54% from Thursday’s (Nov 6) closing price of IDR13,828/kg, reflecting weakening sentiment across both local and regional markets.

According to KPBN data obtained by Palmoilmagazine.com, CPO Franco Dumai opened at IDR13,800/kg but ended withdrawn with the highest bid at IDR13,615/kg. In Talang Duku, CPO opened at IDR13,670/kg and was withdrawn at IDR13,485/kg, while Teluk Bayur recorded a top bid of IDR12,600/kg from an opening of IDR13,246/kg.

The softer tone at KPBN mirrored movements in the Malaysian palm oil market, where benchmark futures continued to slide. Reuters reported that CPO futures on the Bursa Malaysia Derivatives Exchange fell for the fourth straight week on Friday, pressured by expectations of rising inventories and weaker global crude oil prices.

The benchmark January 2026 CPO contract declined RM39 per ton, or 0.94%, to RM4,110 (US$973.01) during the midday session. On a weekly basis, the contract has dropped 2.31%, extending the bearish streak that has persisted since early October.

Preliminary data indicates that Malaysia’s palm oil inventories may have climbed to their highest level in two years, fueled by a production surge reaching its seven-year high. The surge in output reportedly outpaced export demand, adding further downward pressure to prices.

Malaysia’s end-October stockpile is projected to rise 3.5% to 2.44 million tons, the highest since October 2023. The Malaysian Palm Oil Board (MPOB) is set to release its official report on November 10, 2025, which is expected to serve as a key reference for traders gauging the market’s next moves.

Other vegetable oil markets also trended lower. The most active soybean oil contract on the Dalian Commodity Exchange (DBYcv1) fell 0.42%, while palm oil on the same exchange eased 0.21%. In the Chicago Board of Trade (CBOT), soybean oil futures slipped 0.34%, further weighing on the sentiment for edible oils.

KPBN Tender Results (IDR/kg, excl. VAT)

Thursday, November 6, 2025

CPO

- Franco Dumai: IDR13,800 (Withdrawn), highest bid IDR13,615 – IBP

- FOB Talang Duku: IDR13,670 (Withdrawn), highest bid IDR13,485 – WIRA

- Franco Teluk Bayur: IDR13,246 (Withdrawn), highest bid IDR12,600 – WNI

CPKO

- Franco Dumai: IDR25,897 – SDS

- Loco Lampung: IDR25,823 (Withdrawn), highest bid IDR24,325 – IKIN

- Loco Palembang: IDR25,653 (Withdrawn), highest bid IDR24,725 – IKIN

(P2)