PALMOILMAGAZINE, JAKARTA – An increase of up to 6.56 percent in the price of palm oil stocks on Wednesday, October 11, 2023. GZCO’s share price, which rose 6.45 percent, led the increase in the selling price of other palm oil stocks. The increase in GZCO shares also became a momentum for other palm oil stocks.

Meanwhile, the Composite Stock Price Index (IHSG) on Wednesday, October 11, 2023 rose 9.56 points. IHSG rose to the level of 6,931.75.

The increase in IHSG level continued the increase in IHSG since last Monday (9/10) by 2.94 points and Tuesday (10/10) by 30.73 points. The total increase in JCI level during these 3 days, amounted to 43.23 points. With the achievement of JCI level to 6,931.75.

Also Read :

Throughout stock trading, IHSG ranged from 6,917.05 to 6,965.82. Although the IHSG opened at 6,917.06 or decreased by 5.13 points compared to the closing yesterday afternoon (10/10).

Stock trading on Wednesday (11/10) saw 1.24 million transactions with a trading value of Rp. 10.3 trillion.

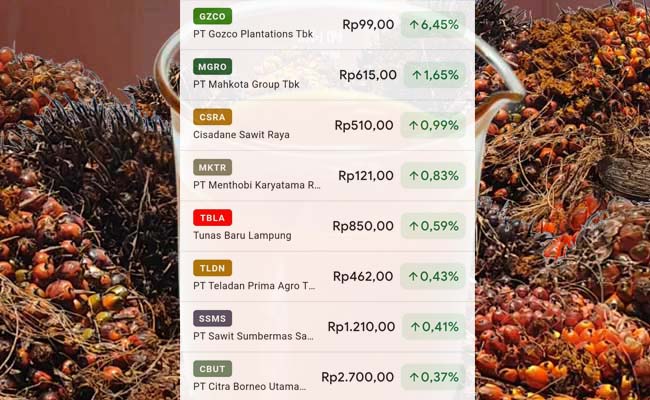

Based on Palmoilmagazine.com monitoring at the Indonesia Stock Exchange (IDX), some stocks experienced an increase in their selling prices. Including the selling price of palm oil stocks, as many as 8 palm oil issuers increased their selling prices.

The following are the selling prices of palm oil stocks on Wednesday, October 11, 2023: GZCO shares or PT Gozco Plantations Tbk, rose 6.45 percent. The selling price of GZCO shares is Rp. 99 per share. MGRO or PT Mahkota Group Tbk. shares, up 1.65 percent. The selling price of MGRO shares is Rp. 615 per share.

CSRA or PT Cisadane Sawit Raya Tbk. shares, up 0.99 percent. The selling price of CSRA shares is Rp. 510 per share. MKTR or PT Menthobi Karyatama Tbk. shares, up 0.83 percent. The selling price of MKTR shares is Rp. 121 per share. TBLA or PT Tunas Baru Lampung Tbk. shares, up 0.59 percent. The selling price of TBLA shares is Rp. 850 per share.

Followed by TLDN, SSMS and CBUT shares. The increase in share selling prices ranged from 0.37 percent to 0.43 percent.

Keep up with the latest information on palm oil issuers only at Palmoilmagazine.com. Mitra Media Networks news network. (T1)